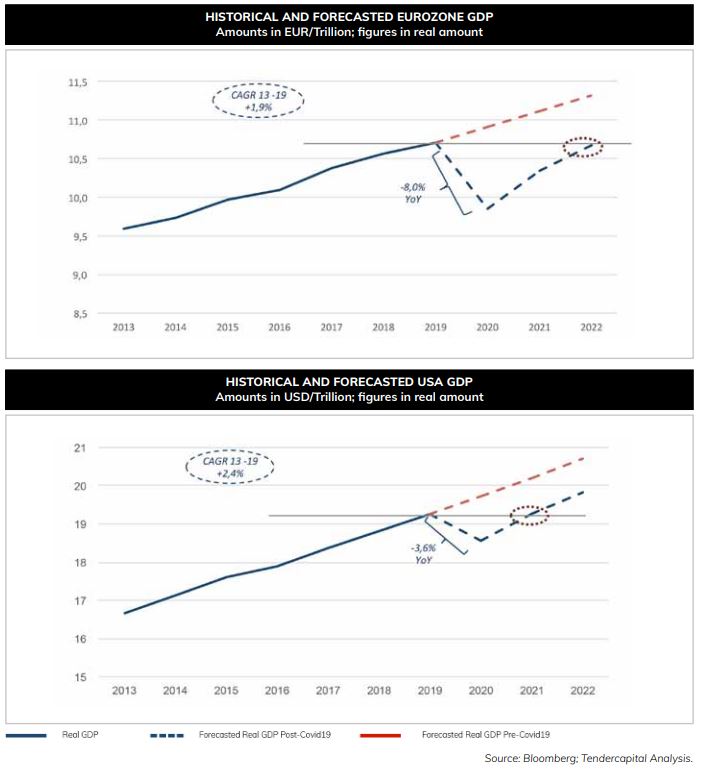

The pandemic crisis has been hardly hitting GDP growth in Europe and US and the ensuing output gap sent the inflation to new lows and further deteriorated the outlook. The dynamic thus triggered an unprecedented synchronized monetary and fiscal response across all major economies. In the current state of affairs, Eurozone and US GDP will likely take several years to reach again pre-Covid output path, with the former expected to return to previous level in 2022 while the latter, one year earlier, in 2021.

In the fixed income market, the interest rate curve highlights expected weakness in Eurozone economy. In 2020, the whole interest rate curve went into negative territory for the first time ever and the yield differential 10y-2y stabilized at 20 basis points at a level seen in financial crisis.

Expected market returns look lower than those realized in the past and capital appreciation potential is stretched, favoring research for carry.

In the equity market, the fallout experienced in March has been followed by a sharp rebound in the subsequent months. A common «script» across all major indexes characterized by the outperformance of the growth segment, further favored by the dynamics of the interest rates market. In this context, stretched valuation has led to the lowest level of perspective returns in decades. Coupled with the uncertain economic environment, we advocate for a defensive stance going into 2021, favored by the reach for yield across underappreciated and uncrowded trade across the value segment.

2020 INSIGHTS

Euro Area GDP Recovery is Expected to Take Place in 2022 while in the US in 2021.

GDP has recovered quickly but it will likely take several years before pre-Covid19 output path will be reached.

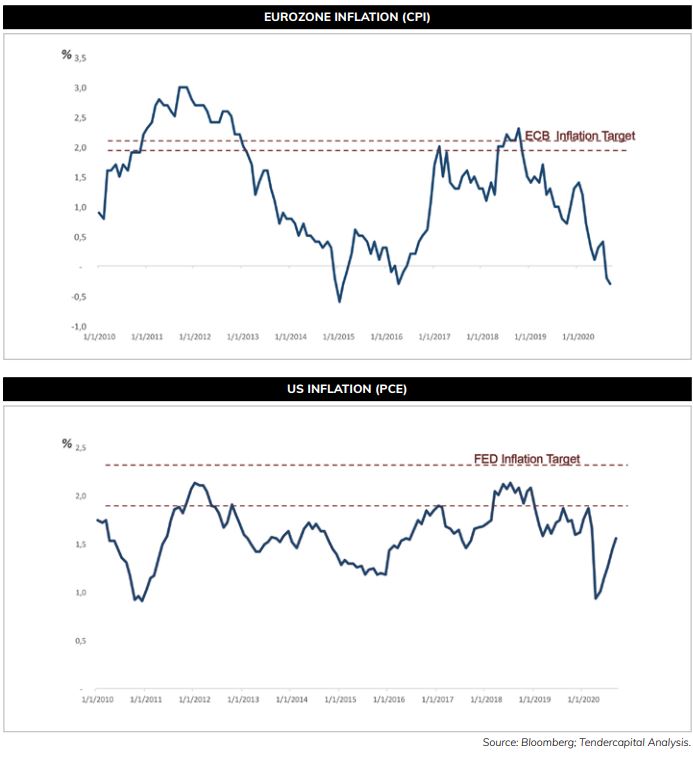

The Output Gap Created by the Pandemic has Sent the Inflation to New Lows.

Central Banks failed to reach the inflation target in the current cycle. The pandemic has further deteriorated the economic outlook

The Pandemic has Fueled a Synchronized Monetary and Fiscal Intervention Across All Major Economies

US and Europe have displayed the biggest policies sending the total expenditure at ~40% of GDP, as per Japan.

The pandemic recession triggered the adoption of fiscal stimulus, which became much more attractive over the time due to the failure of monetary stimulus in the last few years.

- Even if in the past decade governments adopted fiscal austerity, monetary stimulus became the dominant policy lever, as result fiscal and monetary measures often pulled in opposite direction

- In the next decade the past scenario is likely to change and follow a different trajectory, with monetary and fiscal policies complementing each other

- In the medium to long term, both fiscal and monetary policies are likely to increase the upside risk to inflation, in this way closing the output gap in the coming years