ESG Value Proposition

The Fund incorporates ESG aspects into investment decisions through its financial impact on the company, but also by considering non-quantifiable governance matters and social practices. The investment strategy is based on stock selection and thereby focuses on ESG risks that are material for each individual company. The analysis is performed by the portfolio management team with data sourced from MSCI* and by a separate in-house ESG team.

Active Responsible Investment

The fund is signatory of PRI – Principle for Responsible Investment – to identify key environmental, social and governance issue in the market and to proactively promote long-term value and to enhance alignment throughout the investment value chain. Tendercapital incorporates the six principles for responsible investment set out by the PRI in its investment decision in order to promote a sustainable global financial system.

ESG Metrics

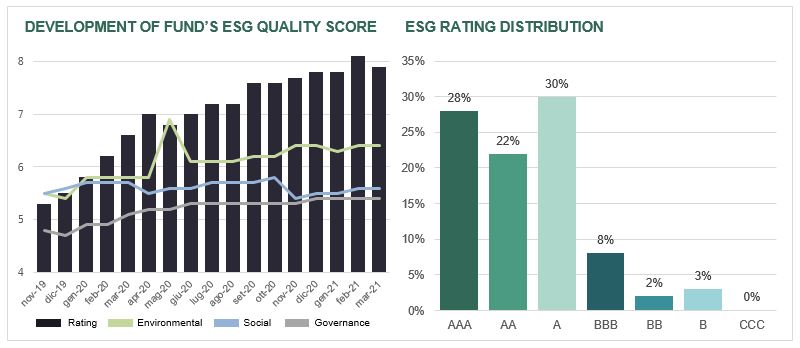

The Fund’s responsibility scores are an assessment of the Fund’s holdings from a responsibility perspective. The Fund’s rating scale from best to worst is AAA, AA, A, BBB, BB, B and CCC. Tendercapital has implemented a Fund’s ESG rating since 2019.

The Fund’s ESG report assesses the Fund’s portfolio holdings from a responsibility perspective. The ESG Quality score measures the ability of underlying holdings to manage key medium to long term risks and opportunities arising from ESG factors. The Fund ESG Quality Score and its sub-factors receive a rating from 0 (low score) to 10 (high score).

Reputational & Controversies Risk Metrics

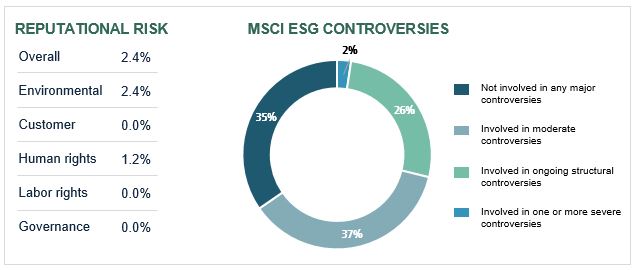

The score analyses each company’s significant social, environmental, and governance impacts by identifying their involvement in major ESG controversies and adherence to international norms and principles. The score helps to comply with international standards and to understand if the Fund has investments in companies involved in very severe controversies.

The MSCI ESG Controversies analyses and monitors company management strategies and their ongoing and past controversies.

Climate Metrics

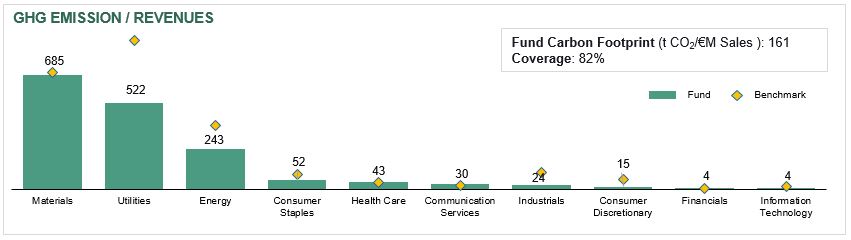

The score analyses companies’ total greenhouse gas (GHG) emission per million of sales reported in the last filings. As an indicator of the gas emission the metric is designed to provide a forward-looking and return-based valuation assessment to measure climate related risks and opportunities in an investment portfolio.

*MSCI is an independent ESG research provider offering a comprehensive global database for analyzing equity and corporate bond investments from an ESG perspective. MSCI uses a rule-based methodology to identify industry leaders and laggards according to their exposure to ESG risks and how well they manage those risks relative to peers. In addition to the overall ESG rating, the Fund is assessed separately based on environmental, social and governance issues. These pillar scores are calculated before industry normalization, i.e. they are not industry-adjusted. Therefore, the Fund’s ESG rating is not an average of the environmental, social and governance pillar scores.

DISCLAIMER: The information in this document does not constitute or form any part of, and should not be construed as investment advice or an offer, invitation, inducement or solicitation to sell, issue, purchase, subscribe for or otherwise acquire shares or other securities, or engage in investment activity of any kind nor shall it or any part of it form the basis of, or be relied on in connection with, any contract therefore. Only the latest version of the fund’s prospectus, regulations, KIID, annual and semi-annual reports may be relied upon as fund the basis for investment decisions. These documents are available on www.tendercapital.com . Information, opinions and estimates contained in this document reflect a judgment at the original date of its drafted and are subject to change without notice. Past performance is not guarantee and it is not a reliable indicator of future results. Performance data does not include the commissions and fees charged at the time of subscribing for or redeeming shares, and the historical statistics are calculated over a minimum of 5 years or less in connection with the date of the lunch of the fund. In any case the performance consider a period of one year. Tendercapital Ltd is authorized and regulated by the Financial Conduct Authority (Registration nr. 540893). Tendercapital Funds Plc is authorized and regulated by Central Bank of Ireland (Registration nr. C110112).